“We started this company in the wake of the Great Recession to use technology and data to bring dramatically better financial advice to people. “It’s an incredible endorsement of our strategy and mission to have such a strong group of Venture and Strategic Investors in this round,” said Michael Carvin, CEO and co-founder of SmartAsset. The company has now raised over $20 million, and will use the new funding to grow the team, expand the capability of its proprietary Automated Financial Modeling (“AFM”) platform and grow Captivate – the company’s recently launched solution for publishers. The round is led by IA Capital Group with participation from TTV Capital, Contour Ventures, Javelin Venture Partners, New York Life, Transamerica Ventures and Fitz Gate Ventures. Its SmartAdvisor service connects consumers with financial advisors.SmartAsset, the financial technology company empowering people with personalized financial advice, announced today that it has raised $12 million in Series B funding.

#New yorkbased smartasset series ttv capital software#

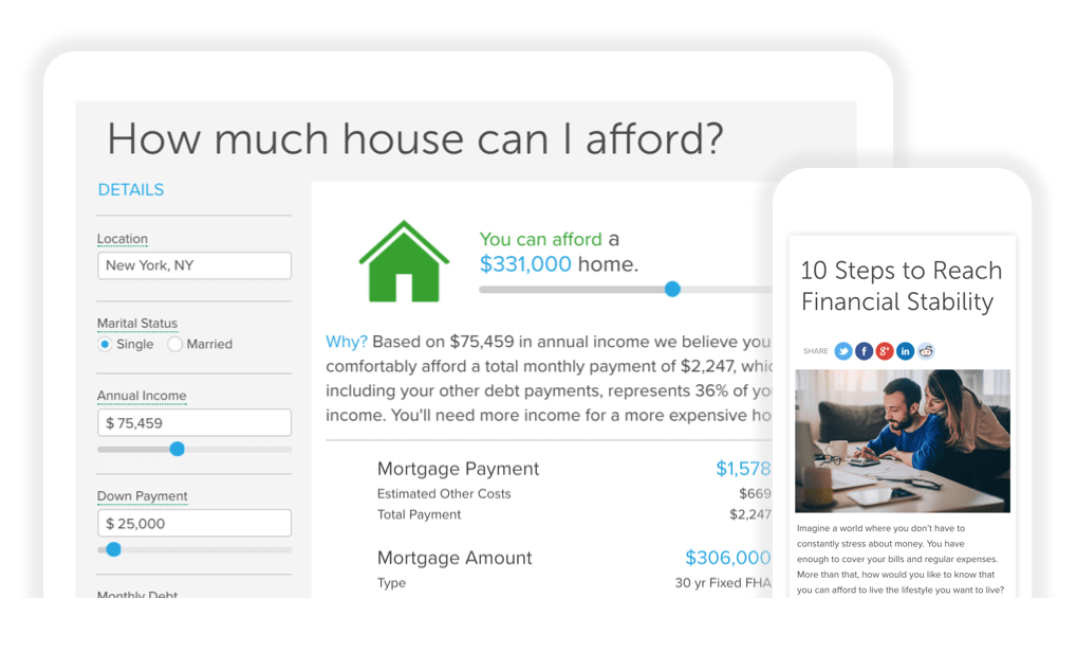

Its proprietary technology, industry leading research and patent-pending Automated Financial Modeling software forecast the impact of different decisions on people's personal finances, enabling millions of people to make smart financial decisions. About SmartAsset SmartAsset is a financial technology company that empowers people with automated personalized financial tools. This year, the company became a six-time honoree of the Webby Awards and a finalist for the Benzinga Fintech Awards, and its Vice President of Content and Financial Education, AJ Smith, was named one of Folio's Top Women in Media.

The company and its team have been the recipients of many industry recognitions and awards including the Webby Awards and Benzinga Fintech Awards. "Given the size of SmartAsset's audience, the SmartAdvisor platform clearly has the potential to meaningfully change how advisors approach marketing and business development in the digital age." SmartAsset has experienced rapid growth in the six years since its founding over the past 12 months SmartAsset's audience has grown by 90%. We see a tremendous opportunity for SmartAsset to create the web's first digital platform to help advisors add new clients in a profitable and scalable fashion," said Rajini Kodialam, Co-Founder of Focus Financial Partners. "We could not be happier to have the support of new and existing investors, bringing with them the expertise and acumen needed for us to accelerate our growth." "Financial advisors currently have no reliable, easy-to-use digital channels to grow their business. In doing so, SmartAsset will become the largest marketplace for investors trying to find financial advisors and advisors trying to meet new prospective clients," said CEO and Co-Founder Michael Carvin. "This investment will accelerate our mission of becoming the web's premier resource for personal finance tools and content. Powered by proprietary Automated Financial Modeling software, SmartAsset's tools, calculators, data-driven studies and educational content provide the web's best personal finance resources, directly to consumers. The six-year-old Y Combinator company provides personal finance information and tools to more than 45 million people each month. SmartAsset plans to use the funding to further grow its audience, as well as expand its fast growing SmartAdvisor platform, which matches consumers to financial advisors. This increases the total funding in the company to more than $51 million. The new investment comes from Focus Financial Partners (which is backed by Stone Point Capital and KKR), Javelin Venture Partners, TTV Capital, IA Capital and Citi Ventures, among others.

SmartAsset, the Internet's most-viewed financial technology company helping people make smarter financial decisions, has raised $28 million in Series C funding.

0 kommentar(er)

0 kommentar(er)